Understanding your consumer isn’t just a nice-to-have—it’s a competitive edge. Consumer research goes beyond demographics and data points; it uncovers the why behind every click, choice, and conversion.

By tapping into real behavior, motivations, and unmet needs, businesses can move from guessing to knowing—shaping products, services, and messages that truly resonate. Whether you’re launching something new or refining what exists, great consumer research helps you see through the eyes of your audience, anticipate trends, and make smarter decisions that fuel growth.

Qualitative Research

Qualitative research uncovers the deeper motivations, emotions, and context behind consumer behavior—revealing insights that numbers alone can’t show.

Focus Group Discussions

Insights emerge in conversation. Focus groups reveal shared behaviors, perceptions, and reactions that surveys and analytics may overlook.

User Persona Building

Users don’t fit into boxes. They shift, adapt, evolve. Personas are more than demographics—they’re snapshots of intent, motivation, and behavioral tendencies.

Observational Studies

What people say isn’t always what they do. Observational studies cut through assumptions, capturing real behaviors in real environments.

In-Depth Interviews

Data tells part of the story. Conversations reveal the rest. In-depth interviews dig deeper—into motivations, pain points, and the context behind decisions.

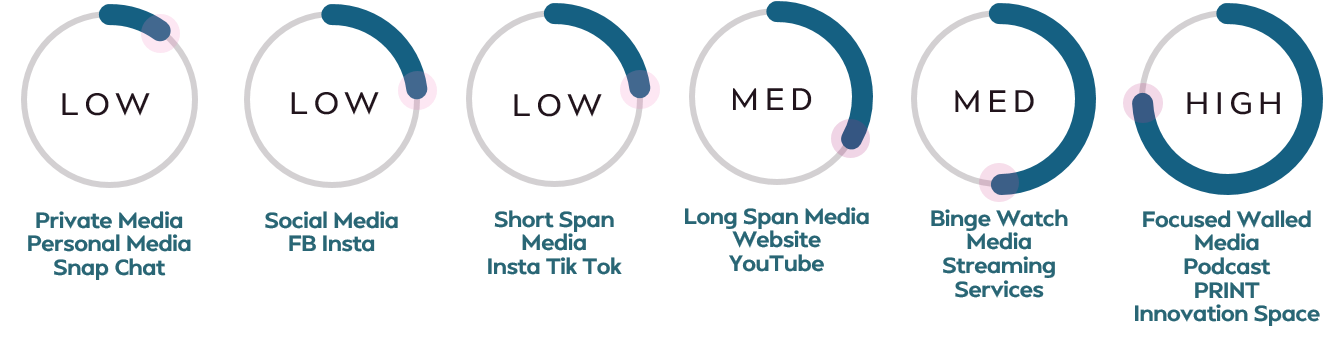

An iconic women’s magazine faced declining print sales. The digital version never took off. The challenge was to transfer the equity and immersive qualities of the print media to the digital channels.

No longer in the age segment or leaving print

Strong brand user but in a declining category

Extremely competitive media landscape and faces challenges to grow

Unlikely to have loyalty and not willing to pay for content

Limited awareness of the brand persona

The magazine’s editorial content has evolved to build a well-aligned user persona of a modern woman.

The content plays a strategic role in expanding the magazine’s franchise and attracting a new audience through various media forms and platforms.

The challenge is to generate content that creates a consistent and complete understanding of the brand in a short-span media.

Content strategy must include novelty, relevance, entertainment, newsworthy, true-to-persona elements.

Our client site had the easiest application form but the lowest conversion rate.

There was a significant decline in brand equity ratings following consumer visits to the website.

The website was destroying brand equity. Why?

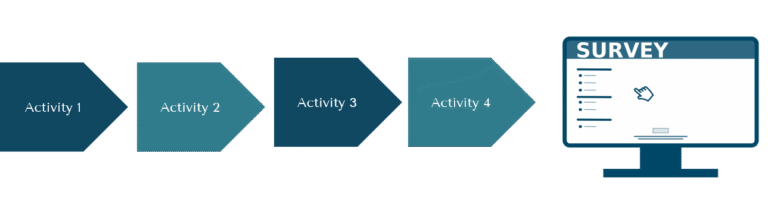

Respondents were instructed to shop online for a few everyday products, either for themselves or for their family members. They would have four shopping tasks to complete, each lasting 10 minutes. After each shopping task, they would take a quick survey in the lab and then move to the next task.

Respondents were free to choose any site they wanted to visit.

Each task was to be completed in 10 minutes, followed by a 5-minute in-lab survey.

The in-lab survey primarily captured the sites they visited and were most likely to use, the brands considered, and the chosen ones.

NOTE: Task instructions were tailored for regular and occasional users within each OTC category, based on the respondent’s usage status.

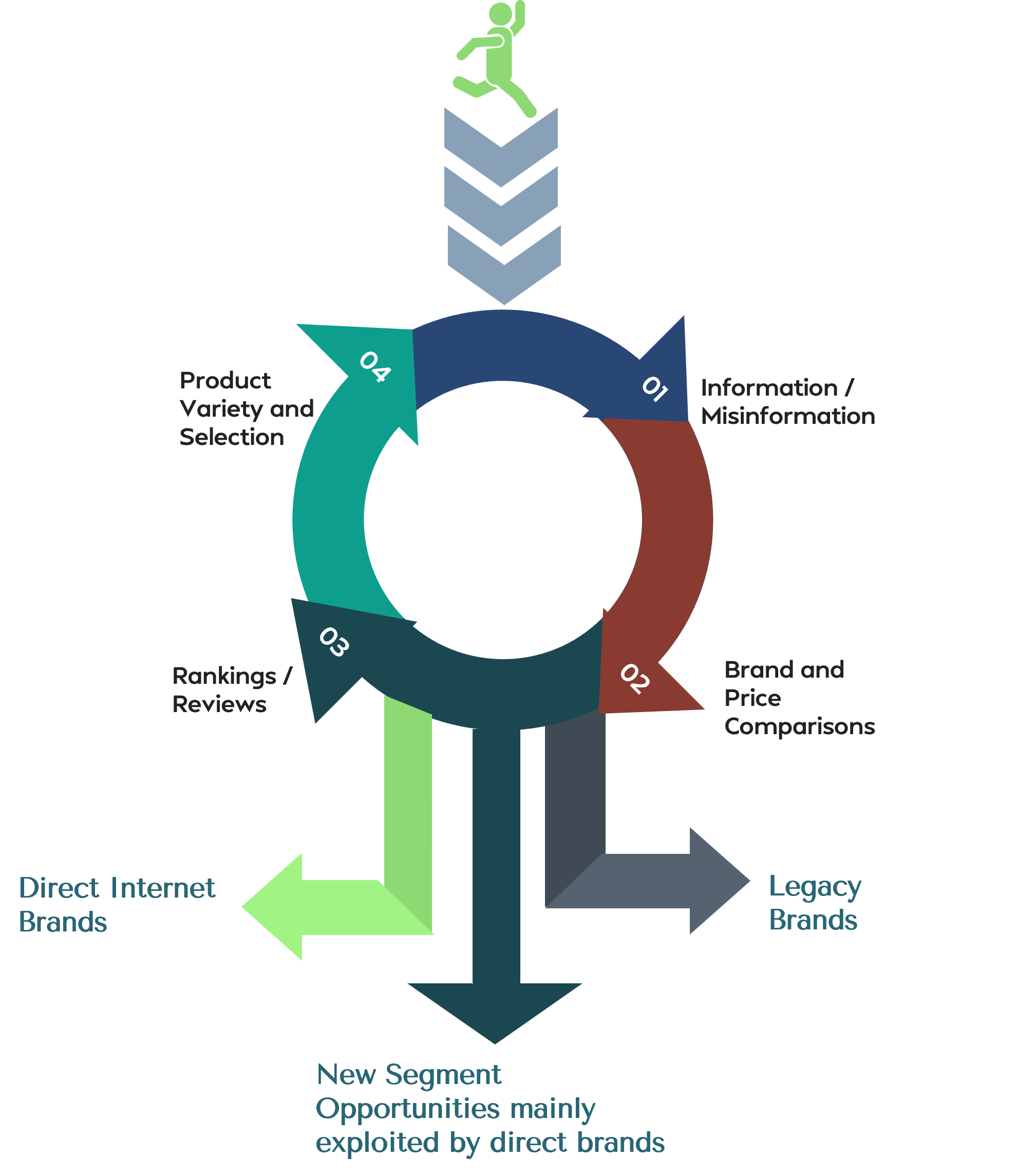

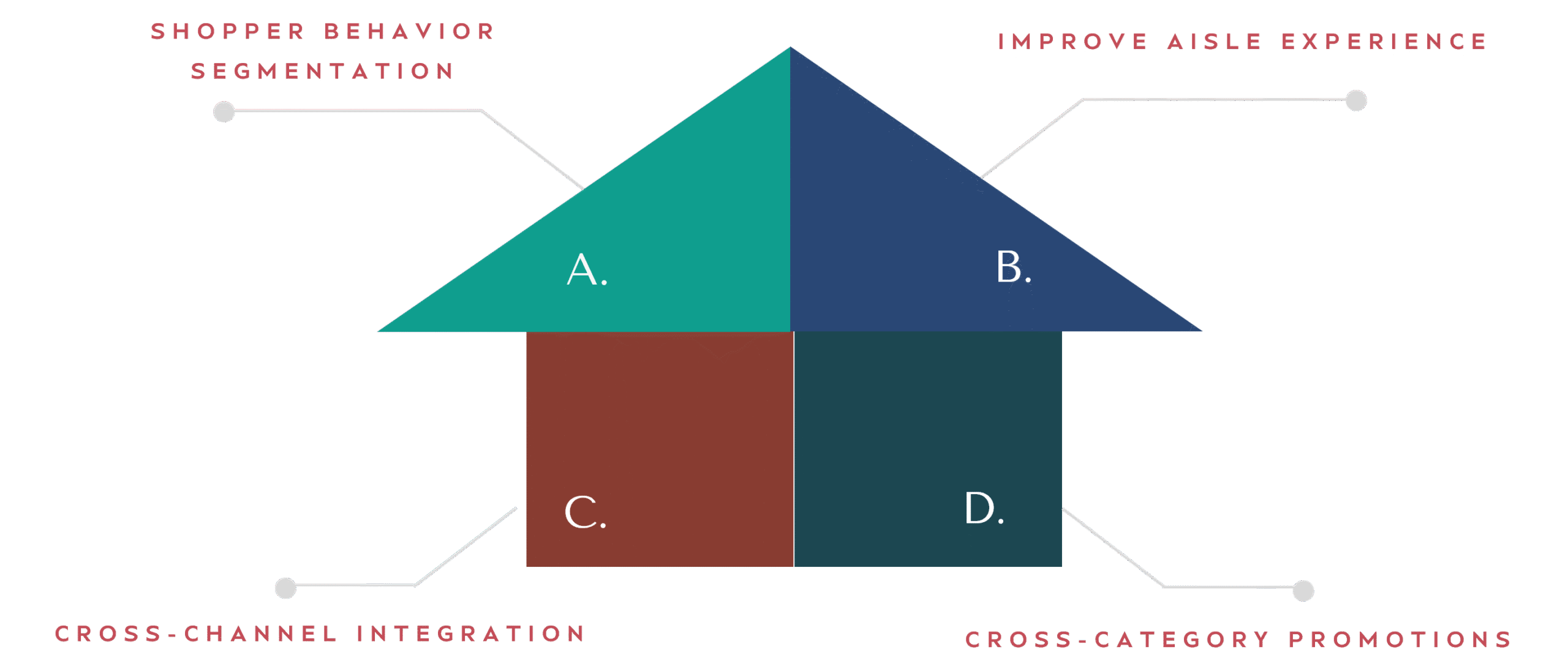

The omnichannel marketing chain is not a series of touchpoints. Consumers face an array of information and misinformation sites on the Internet, as well as customer reviews on sites like Amazon, which can lead to new brand learning and brand switching. Strategies to influence brand choice on the Internet must understand this eco-system.

In the Omnichannel Lab, we observe consumers interact in the Mock Retail Store and on the Web in the Group Lab. This is useful for combating misinformation and developing compelling strategies to influence consumer learning and decision-making.

Pre and post-brand ratings, consideration, and choice are used to model the impact of omnichannel learning on brand shares in the category.

In the Omnichannel Lab, we observe consumers interact in the Mock Retail Store and on the Web in the Group Lab. This is useful for combating misinformation and developing compelling strategies to influence consumer learning and decision-making.

Pre and post-brand ratings, consideration, and choice are used to model the impact of omnichannel learning on brand shares in the category.

Selected strategies and tactics are tested in the Lab for final validation and predictive modeling.

The eye tracker lab, using advanced 3D eyeglasses, captures detailed gaze patterns and attention hotspots, offering deep insight into visual engagement. Finally, a post-experience interview explores motivations, challenges, and decision-making processes.

This seamless flow—from interview to interaction to analytics—helps us deliver a holistic view of consumer behavior, blending what people say with what they actually do.

320 shoppers looking to buy a device in the next 90 days. The screener includes pre-shopping questions for pre/post comparisons.

Four cells, resulting in four different physical layouts, with 80 shoppers per cell. Shoppers will only see and shop one layout.

Shoppers enter mock stores and shop as they normally would, choosing they device they would be most likely to purchase.

320 shoppers go to a separate room where they take a quantitative survey covering their device choice and shopping experience.

Two Cell Design

Without iPOS

n=75

With iPOS

n=75

All taking a pre & post survey.

Ten shoppers wore glasses to track their in-store shopping behavior and were then debriefed by a researcher.

We’d love to hear from you!

Please enter your contact details if you want to know how we can help your business through strategic research, UX/UI design, or brand innovation.